Navigating Supply Chains When Suppliers Go ‘Poof!’

In 2023, Yahoo! Finance reported that “more than half (52 percent) of the companies in the Fortune 500 list of 2003 no longer exist today.” According to the U.S. Bureau of Labor Statistics, 65 percent of companies typically fail during the first 10 years of existence.

How close to home are potential failures in your supply chain?

To illustrate, let’s look at supplier closures in just one spend category, the logistics industry, which moves goods upstream and downstream along the supply chain. In 2017, the world’s seventh-largest maritime shipping line, Han Jin Shipping, declared bankruptcy, leaving nearly 400,000 containers stranded on inactive ships.

Yellow Freight closed in 2023. At the time of bankruptcy, the company was the country’s third largest less-than-truckload (LTL) carrier. NBC News reported that “The U.S. lost as much as 15 percent of its small-batch trucking capacity,” while The Wall Street Journal reported “The trucker’s competitors are reaping a windfall of business, while customers face rising shipping costs.”

Analyzing data from the U.S. Department of Transportation Federal Motor Carrier Safety Administration (FMCSA), TruckInfo.net discovered that more than 1,500 freight brokers closed their doors in 2023. Many of those brokers linked procurement buyers and the carriers moving their goods. One leader, freight brokerage Convoy, shut down operations in October with reportedly more than 80,000 carriers in its network.

Few companies were unaffected by supplier closures. However, even if your shipments weren’t frozen in place, the failure of a major supplier may force up prices. Wouldn’t it have been better to have advance warning of these failures?

Gain Risk Visibility with Every Supplier

These transportation examples are just one instance. How many spend categories besides transportation/logistics can disable your company? Consider the effect of any key provider failing in contract manufacturing, information technology, human resources, energy, cybersecurity and the like.

With most companies having hundreds or thousands of suppliers, how can procurement professionals monitor risk across their entire supplier portfolio?

The answer can be found in the Pareto principle, otherwise known as the 80/20 rule. Richard Koch, the originator of the Pareto principle, once said, “The way to create something great is to create something simple.”

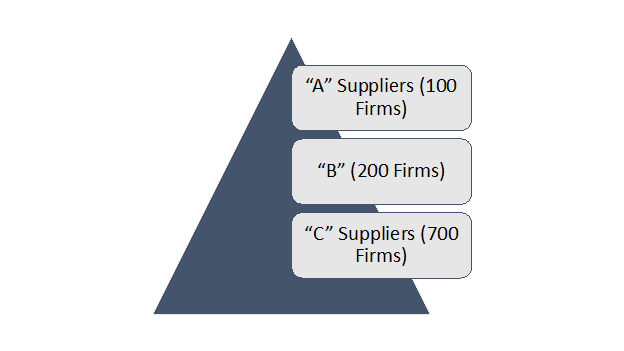

Applied to supplier risk exposure, procurement teams can use the same Pareto methodology used for supplier relationship management to strategically address supplier risk management. This can be as simple as creating a risk-based ABC compartmentalization of your supplier universe. Consider the following example of ABC segmentation for a company with 1,000 suppliers:

The trick to building appropriate visibility to the stability of a thousand different suppliers is to create a comprehensive platform of information and alerts foundational to all. Categorization of suppliers by risk can be done a number of ways, including:

- Supplier spend size

- Transaction volume

- Source segmentation (categories lacking dual or tri-source diversification)

- Product criticality (tied to a digital bill of materials).

Create Baseline Risk Visibility

Every company can actively monitor and report on foundational risk elements for each supplier relationship, at little or no cost. A baseline of deep risk visibility across your entire supplier portfolio can be easily achieved through a disruptive provider that is “Amazoning” or “Ubering” the supplier risk industry with a no-cost cloud solution. For every one of a firm’s Class A, B, and C supplier relationships, this provider can:

- Validate each supplier’s taxpayer identity

- Actively check each supplier for presence on up to 1,500 governmental watch/exclusion lists around the globe

- Proactively monitor each supplier’s financial stability via a predictive financial stability score performed by a top global credit management provider

- Conduct a five-year retroactive look back, as well as actively monitor supplier bankruptcy filings, criminality convictions and lien filings

- Monitor up to 30,000 global news sources for negative media reports on each supplier (for example, plant fires/disasters, litigation exposure, court judgements, labor disruptions or data losses)

- Conduct a cyber security assessment of each supplier’s external IT environments

- Digitally collect and verify supplier insurance coverage and endorsement language

- Actively check for supplier presence on the U.S. Office of Foreign Assets Control (OFAC) list

- Collect and verify supplier diversity certification

- Track worksite safety and environmental incidents

- Collect other documents such as International Organization for Standardization (ISO) certifications, non-disclosure/mutual non-disclosure agreements (NDA/MNDA), supplier code of conduct, and information security or environmental impact/emission questionnaires.

A surprising number of C suppliers are critical to supply chains. That is why risk management must actively monitor all suppliers, whether A, B or C.

Further Risk Monitoring

Having achieved full visibility to the foregoing risk elements for every supplier, your procurement team can add automated information and staff involvement to identify greater supply chain vulnerability in Class B suppliers. Tasks should be harmonized with monitoring of other supplier relationship information, like on-time deliveries, line-item fill rates, product/service quality and invoice accuracy.

These types of metrics can usually be extracted from most P2P, ERP or even MRP technology platforms and pushed out to suppliers and applicable procurement and operational managers in an automated scorecard. Observant supplier managers should investigate performance deficiencies in their suppliers to understand root causes. Performance flaws and questionable risk factors should be discussed with Class B suppliers in annual or semi-annual business meetings.

Class A suppliers should be actively score-carded on performance and risk metrics as well as subjective qualitative elements by procurement and operational teams. Proactive monthly or quarterly business meetings should focus upon performance as well as risk mitigation. Plans for critical supplier continuity should be developed in regard to geopolitical events. Augmenting foundational, direct Class A supplier component impact may be further enhanced using additional licensed technology services (at a cost).

There’s no excuse for a supply management organization to fail to comprehensively manage supplier risk. NBA star Michael Jordan once said, “Some people want it to happen, some wish it would happen, others make it happen.” Organizations don’t need to make supplier risk management more complicated than needed. But they do need to use sound methods to make it happen.