Geopolitical Risks: What Keeps Us Up at Night

Many headlines and news stories are reflected in our supply chains. Whether formulating a long-term supply chain strategy or making daily adjustments through spot buying or ad-hoc shipping, geopolitics are often at the core of supply chain decisions.

Having visibility into geopolitical factors and risks through data and analytics can allow for better hedging, resource planning and overall strategy. Geopolitical risk is constantly shifting, even as we sleep.

Geopolitical risk can be defined by human and geographic events occurring in one country or region that impact global stability, economic performance and business operations throughout the world. It can manifest in a variety of ways and often stems from three main areas:

- Economic: Recession, inflation, commodity price shocks and debt crises

- Natural and environmental: Climate change, extreme weather, pandemics and natural resource availability

- Political: War and terrorism, cyberattacks, civil unrest, policy change, sanctions and blockades.

In many cases, the ripple effects of these geopolitical events are interrelated. They can disrupt global supply chains by blocking shipping channels, restricting access to inputs and resources, or even threatening corporate reputation. Improving data tracking and analysis of geopolitical risk can empower agile responses to save the bottom line.

Defusing Geopolitical Risk

The Russia-Ukraine war is a prime example of a geopolitical event that has interrupted global business activity. Physical blockades to trade routes, the destruction of production sites and logistics centers, along with multi-country sanctions against Russia, have resulted in supply shocks to some of the world’s most in-demand resources.

Inflation of energy, agricultural products, and metals and minerals raised operational costs and squeezed profit margins for businesses globally. This was a logistical and sourcing nightmare for those unprepared.

Similarly, the Suez Canal blockage in 2021 highlighted the vulnerability of critical maritime routes. When a massive container ship became lodged in the canal for six days, it caused a severe bottleneck for commercial ships. Just-in-time production models, such as automakers, were forced to suspend production due to delays in receiving parts, and consumer goods manufacturers struggled with shortages of essential components. The blockage demonstrated how a single chokepoint in the supply chain could lead to extensive delays in production schedules, increased shipping costs and stock shortages.

Fortunately, there are analytics techniques companies can adopt to curb the effect of such a high-impact event. To start, a cleansed spend cube and supply chain mapping can offer a strong data foundation. A cleansed dataset will offer improved data quality and accurate outputs for data reporting and modeling. Meanwhile, supply chain mapping provides visibility to Tier-2 and Tier-3 suppliers and uncovers vulnerability points.

With a strong foundation in place, what-if analyses can be explored to simulate possible risk events and understand the impact of changing variables. For instance, a what-if scenario could have been designed in the Russia-Ukraine example to preemptively simulate the impact of military conflict in eastern Europe.

Large fertilizer companies like Australia’s Wesfarmers would have especially benefitted from this insight. The global fertilizer market was hit hard by the war due to the world’s reliance on Russian metals and minerals. By utilizing this hypothetical model, fertilizer companies would have had foresight into the potential impact to lead times, supplier availability and associated costs. They likely would have fared better than their counterparts by simply understanding their vulnerabilities and having a plan in place to pivot accordingly.

Likewise, a contingency plan could have been employed to mitigate the impact of the Suez Canal blockage. Ikea is one company that was hit particularly hard by the crisis through stockouts, as the freight partners that manage its shipments were trapped in the blockage. With a clear contingency plan in place, Ikea could have outlined local suppliers that could have assisted during this crisis.

Planning for alternative trade routes or sourcing strategies could have accelerated customer delivery and softened the impact of stockouts. In either example, these major geopolitical disruptions have highlighted the need for advanced analytical techniques to minimize financial ramifications.

The Coronavirus Pandemic

Perhaps the main impetus for this paradigm shift was the largest global disruption of the 21st century — the coronavirus pandemic. When global production and business activity shut down, companies had no blueprint to follow, and many sought support from technology experts like IBM.

At the height of the pandemic, for example, IBM developed a COVID-19 dashboard for clients, leveraging real-time data on infection and mortality rates by country and region. This dashboard integrated COVID-19 statistics with spend data, focusing on key suppliers and expenditures in affected areas. It also featured a “risk exposure” calculation that grouped countries based on the percentile rank of confirmed cases.

As a result, procurement teams were empowered to visualize potential disruptions, prioritize critical suppliers and to mitigate risks in an unprecedented global crisis. Having early access to this information at a time where risk analytics were not yet as developed allowed IBM and clients to make key decisions around production, ordering of personal protective equipment (PPE) and business continuity.

Capturing Critical Data for Risk Management

Capturing data to gauge geopolitical risk can be tricky, though new methods are continuously being developed. Third-party software and data providers such as Sphera (formerly riskmethods) connect risk data with client information to monitor various risk factors more effectively.

Some providers like Sphera have begun to leverage artificial intelligence (AI) to map a company’s supply network or alert users of risk events. Other third-party providers offer different specialties like sustainability and ethics tracking (Ecovadis), supplier risk (Dun & Bradstreet’s D&B Compass) or environmental, social and governance (ESG) standards compliance (Source Intelligence).

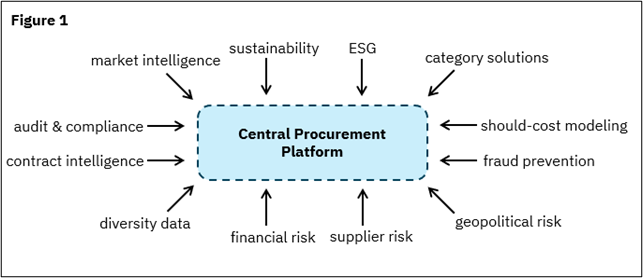

With each of these data providers serving a unique niche, procurement departments often feel they have no choice but to purchase data from multiple providers to meet data tracking needs. The below graphic illustrates just how many types of data inputs are considered by procurement leaders today.

Data inputs considered by procurement leaders. (Courtesy of Benjamin DiPiazza and Myrto Chrysafidi)

As an alternative to third-party data providers, many organizations instead opt for partnerships with managed services. Managed service, like IBM Procurement Analytics as a Service, offer a comprehensive data solution leveraging the service’s (1) market intelligence and (2) network of best-in-class partnerships with providers in such areas as risk and ESG standards. Having access to various data impacts in one central place rather than multiple data centers saves time and effort for data users, so users can instead devote time to high-value tasks such as driving data insights.

Whether through a third-party or managed service, it is vital to understand which KPIs matter most to your procurement team. Regions of operation can be assessed for political and economic stability and natural disaster risk, while suppliers can receive risk ratings based on historical performance, regulatory compliance and geopolitical stability within their region.

Additionally, supply chain resilience scores can evaluate a supply chain’s ability to shift production or sourcing based on supplier diversification or geographic distribution. The power comes with knowing which KPIs and risk factors are relevant to your industry and strategic goals.

For example, companies with complex global supply chains will find that gauging operational risk is paramount to performance. IBM’s expertise in risk analytics was recently employed to predict a client’s risk factor across their production sites. Invoice and PO text analytics of MRO data were evaluated to determine which production plants had a proactive (maintenance-based) or reactive (repair-based) approach, the latter assuming a higher risk factor for a longer production halt.

With this newfound insight, the client was notified of the supply chain vulnerabilities that would be most impacted when faced with a geopolitical disruption. As a result, the client may opt to diversify production or invest in preventive maintenance at their high-risk plants.

This example highlights the power of timely or real-time data tracking. When risks and their potential impacts are immediately apparent, decisions can be made more proactively. Why frantically pull reports during a high-risk disturbance, when you can have that data already at your fingertips?

How is Geopolitical Analytics Evolving?

Geopolitical analytics is transforming rapidly, heading closer to real-time tracking through the infusion of advanced technologies. AI is already being used to make predictions faster and more accurate than ever before.

Moving forward, we can expect AI-driven predictive analytics to forecast geopolitical events by scouring news, social media and economic reports to identify early signs of political unrest or trade policy changes. These insights enable procurement teams to anticipate disruptions and adjust sourcing strategies accordingly.

Machine learning algorithms can also identify patterns and correlations that humans might miss. For instance, a machine learning system could detect a correlation between certain weather patterns and supply chain disruptions, allowing companies to plan better for such events.

In the future, we can also expect enhanced data management to transform global supply chains and reduce geopolitical uncertainty. Supply chains continue to develop secure, traceable and verifiable methods of data tracking, which serves as a powerful input for strengthening machine learning models and improving their accuracy. Additionally, having the capability to track the movement of goods in real-time can provide transparency when navigating politically sensitive regions or high-risk zones.

Through more sophisticated AI, machine learning and data tracking, among other technologies, supply chain leaders will be better equipped to respond quicker and more tactically to geopolitical emergencies.

***

In a world where uncertainty is the only constant, geopolitical analytics allows firms to maintain a competitive edge in a volatile global market. Geopolitical risk can be reduced through proper analytical techniques and data collection, thereby enabling organizations to respond to disruptions and mitigate risks in their supply chains.

As technology continues to advance, the ability to predict, analyze and act on geopolitical events will become an indispensable tool for procurement leaders of the future. Geopolitical risk management is not only a safeguard to protect operations, but also a smart investment that is poised to pay dividends down the line.